You're getting ready to sell your business.

You've spent years building it. You know every customer, every product, every challenge you've overcome.

But when a buyer shows up, they don't care about your stories.

They care about your numbers.

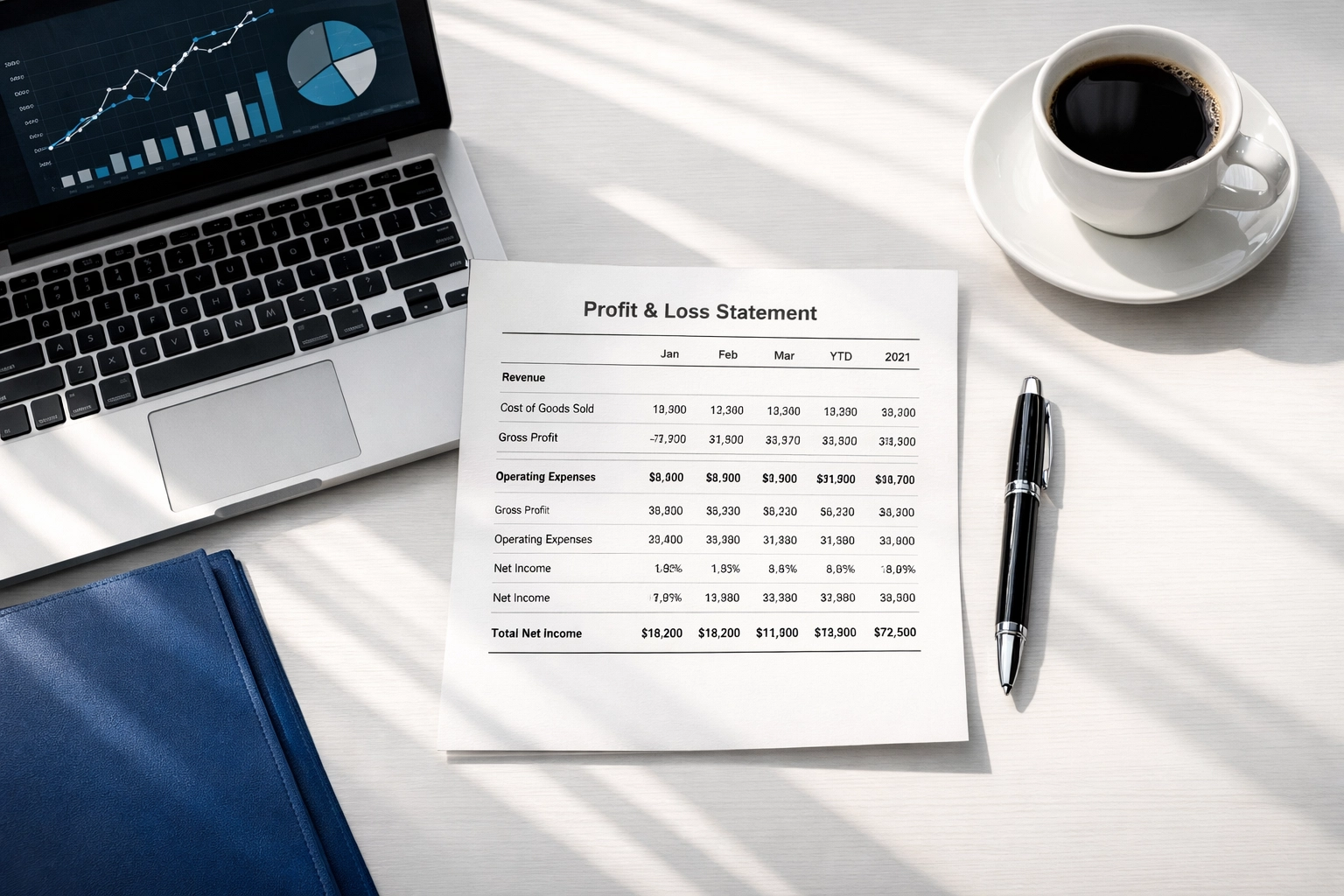

And specifically, they care about your Profit & Loss statement.

Your P&L isn't just a financial document. When you're selling a business, it's your best marketing tool. It's the single most powerful piece of evidence that your business is worth what you're asking.

Clean books tell a buyer: This business is real. This owner is organized. This deal won't blow up in due diligence.

Messy books? They scream the opposite.

Your P&L Is the First Thing Buyers Actually Believe

You can tell a buyer your business is thriving. You can show them your vision for growth. You can talk about customer loyalty and market opportunity.

None of that matters if your P&L doesn't back it up.

Buyers are skeptical by nature. They've seen inflated promises before. They've been burned by owners who "rounded up" their revenue or forgot to mention certain expenses.

Your P&L is the proof.

It shows them exactly what comes in and what goes out. It tells them whether your business is profitable, sustainable, and worth their investment.

If your P&L is clean, clear, and organized, you've just done half the selling for yourself.

If it's a mess? You're starting from a position of doubt.

What "Clean Books" Actually Means

Let's be clear about what we're talking about here.

Clean books don't mean perfect books. They mean accurate, organized, and explainable.

Here's what buyers want to see:

- Consistent categorization – Expenses are in the right buckets every time

- Owner compensation separated – They need to see what the business earns vs. what you take home

- Personal expenses removed – Your car lease and family cell phone plan don't belong on the business P&L

- Add-backs documented – One-time costs or discretionary spending clearly identified

- No surprises – Revenue and expenses match your tax returns and bank statements

If a buyer opens your financials and has to guess what a line item means, you've already lost credibility.

Clean books are confident books. They show you know what's happening in your business: and that you're not hiding anything.

Messy Financials Kill Deals (Or Tank Your Price)

I've seen it happen more times than I can count.

An owner walks in with a strong business. Good revenue. Solid margins. Great reputation.

Then we look at the books.

Revenue is lumped into one category. Expenses are all over the place. Personal and business spending are mixed together. Tax returns don't match the P&L.

The owner shrugs and says, "My accountant knows what it all means."

Here's the problem: Your accountant isn't buying your business.

When buyers see messy financials, they assume one of three things:

- You don't actually know your numbers

- You're trying to hide something

- This deal is going to be a headache

All three kill your leverage.

Even if your business is genuinely profitable, a buyer will discount your asking price just to account for the risk of unraveling your books.

Or worse: they'll walk away entirely.

How Clean Books Boost Your Business Valuation

Here's where it gets interesting.

Clean financials don't just make buyers feel comfortable. They actually increase what your business is worth.

When your P&L is clear and organized, buyers can see the real profitability of your business. They can calculate a business valuation with confidence.

More confidence = higher offers.

Buyers pay more when they trust the numbers. They're not building in a discount for uncertainty. They're not holding back cash in escrow to cover potential surprises.

They're making their best offer: because they believe your business is exactly what you say it is.

Add-backs make an even bigger difference here.

If you've been running personal expenses through the business or paying yourself below market rate, those add-backs can significantly increase your adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

But only if they're documented correctly.

A buyer needs to see:

- What the expense was

- Why it won't continue under new ownership

- Proof that it actually happened

If you just scribble "Add back $50K in owner perks" on a napkin, no one's buying it.

Clean documentation = legitimate add-backs = higher valuation.

What We Do to Help You Clean Up Your Books

At Vision Fox Business Advisors, we see plenty of businesses with solid fundamentals but chaotic financials.

The good news? This is fixable.

Before we ever take your business to market, we help you clean things up.

Here's how:

Review your last three years of financials – We look at your P&L, balance sheet, and tax returns to see what buyers will see

Identify issues that hurt your valuation – Mixed expenses, inconsistent categories, missing documentation

Work with you (and your accountant) to reorganize – We don't redo your books, but we help structure them in a way that makes sense to buyers

Document add-backs clearly – We make sure every dollar you claim as discretionary or one-time is defensible

Prepare a clean, buyer-ready financial package – One that tells your business's story without confusion

This process doesn't take months. But it makes a massive difference in how buyers perceive your business: and how much they're willing to pay.

Your P&L Tells a Story. Make It a Good One.

Think of your P&L as your business's resume.

You wouldn't send a resume with typos, random fonts, and gaps in employment to a hiring manager.

So why would you hand a messy P&L to someone considering a six- or seven-figure investment in your business?

Your financials should tell a clear story:

- This business makes money consistently

- The owner knows what's happening at every level

- There are no hidden landmines

When your P&L tells that story, buyers stop questioning and start negotiating.

Florida Business Owners: Start Early

If you're a business owner in Florida thinking about an exit in the next 12-24 months, now is the time to get your books in order.

Don't wait until you're ready to list.

How to sell a business starts long before you talk to a buyer. It starts with making sure your financials are clean, clear, and credible.

As a business broker in Florida, we help owners across the state prepare their businesses for sale: starting with the numbers.

Because when your P&L is clean, everything else gets easier.

The Bottom Line

You can have the best business in the world.

But if your books are a mess, buyers won't see it.

Your P&L is your marketing. It's the proof that your business is worth what you're asking.

Clean it up. Organize it. Make it tell a story that builds confidence.

That's how you maximize your business valuation and attract serious buyers.

If your financials need work before you're ready to sell, we can help. At Vision Fox Business Advisors, we specialize in getting businesses ready for a successful exit.

Reach out to us today for a free consultation. Let's make sure your numbers work as hard as you did to build your business.

FAQ

How far back should my financial records be cleaned up before selling?

Most buyers want to see three years of financials. Focus on getting your last three years organized, accurate, and consistent. If there are major discrepancies in earlier years, be ready to explain them: but prioritize the most recent data.

Can I clean up my books myself, or do I need a professional?

You can do basic cleanup yourself if you're organized and understand accounting principles. But for a business sale, it's worth having a professional (CPA or business broker) review everything. They'll catch issues you might miss and know what buyers will scrutinize.

What if my tax returns show lower income than my actual profit?

This is common: and fixable through add-backs. You'll need to document discretionary expenses, owner perks, one-time costs, and below-market salaries. Just make sure every add-back is legitimate and provable. Buyers will verify.

Do clean financials really increase my sale price?

Yes. Clean books reduce buyer risk, which increases their confidence and willingness to pay full price. Messy financials often result in lower offers or deals that fall apart during due diligence. The difference can be tens or hundreds of thousands of dollars.